Automate High-Risk Onboarding: Streamline Risky Processes

Learn the best practices to automate high-risk onboarding, reduce security risks, and ensure a smooth, compliant onboarding experience.

For payment service providers and acquirers

Your merchants rely on you — and your success depends on the tools behind your service. With beGateway, over 125 PSPs and financial institutions have launched and scaled payment services under their own brand, quickly and confidently.

Go live in 1 week

Global connectors

White-label experienc

Compliant & secure

Expert support

Give your merchants the tools to convert more, manage better, and scale globally

With our SaaS model, your gateway can go live in just 7 days, including branding and system setup. Depending on your infrastructure, on-premise installations typically take 3+ months.

Yes. You get a fully branded experience — your logo, domain, and colors. Merchants see your brand at every touchpoint.

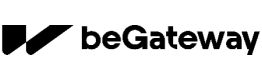

beGateway supports over 170 payment connectors, including Visa, Mastercard, Apple Pay, Google Pay, Klarna, iDEAL, UnionPay, and many more. You can also request custom integrations.

Absolutely. beGateway supports tokenized recurring payments, smart retry logic, and full automation — ideal for SaaS, memberships, and more.

Our AI-powered fraud engine includes real-time scoring, automated 3D Secure, blacklists/whitelists, and Smart Routing — all designed to reduce fraud and boost approvals.

Not necessarily. We offer pre-built plugins for 40+ shopping carts and multiple integration options (API, SDKs, hosted checkout), so merchants can start accepting payments quickly — no dev team required.

Yes, beGateway is certified to PCI DSS 4.0 Level 1 — the highest standard in payment security. We also support GDPR and PSD2 compliance.

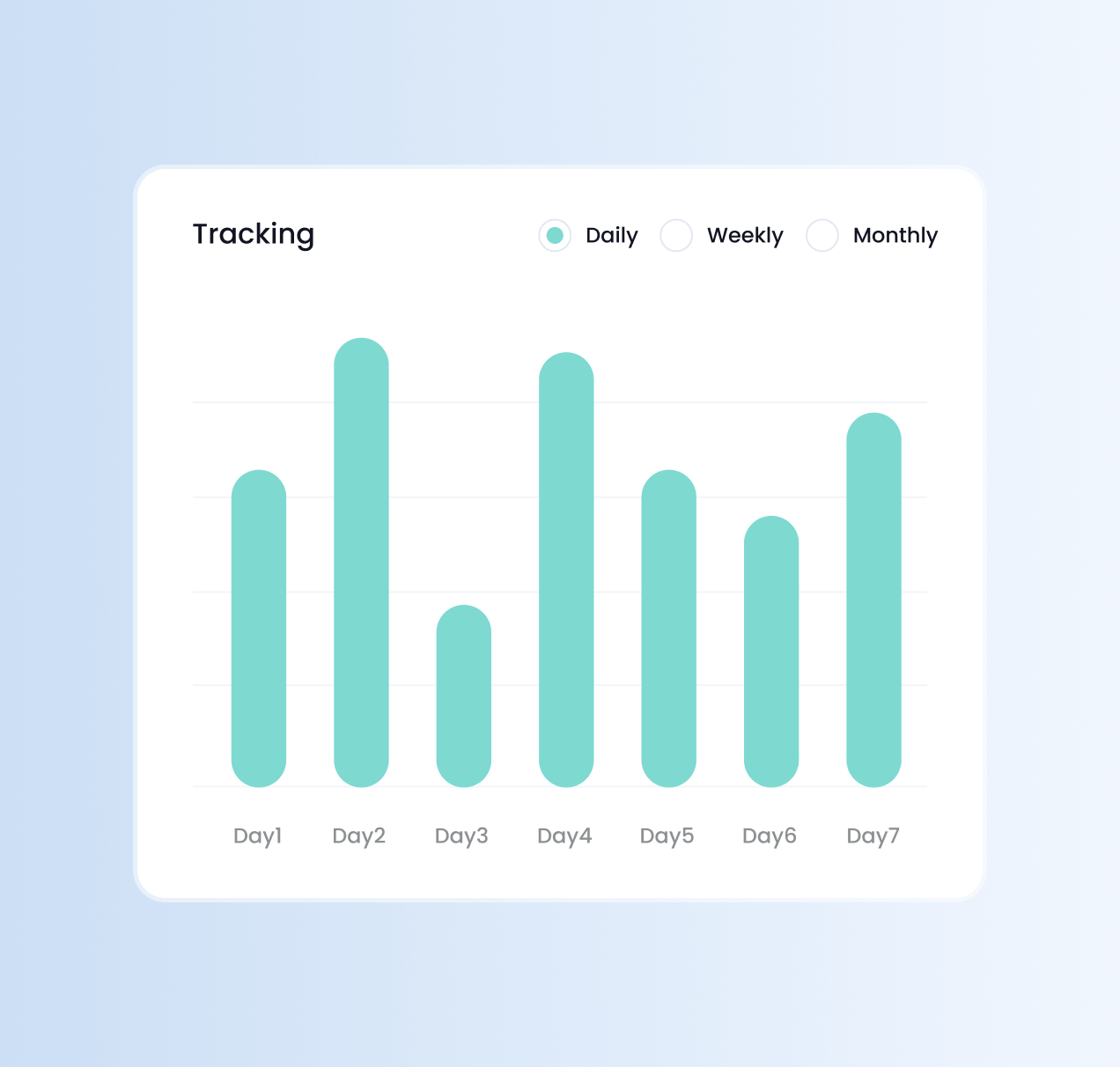

You get real-time dashboards, decline code analysis, custom reports by merchant/method/currency, and exportable data for BI and reconciliation.

Yes. Set custom commissions, enable surcharges, automate FX conversions, and connect to your preferred exchange rate provider — all in real time.

You get 24/7 expert support, a dedicated account manager, integration help, and ongoing guidance on compliance, optimization, and risk management.

in a few days, not a year