Custom payment solutions

Unlock business growth with custom payment solutions tailored to your needs. Discover secure, flexible options for seamless transactions today.

For payment service providers and acquirers

Build your payment gateway service powered by a pre-built white label payment gateway solution and an expert technical team.

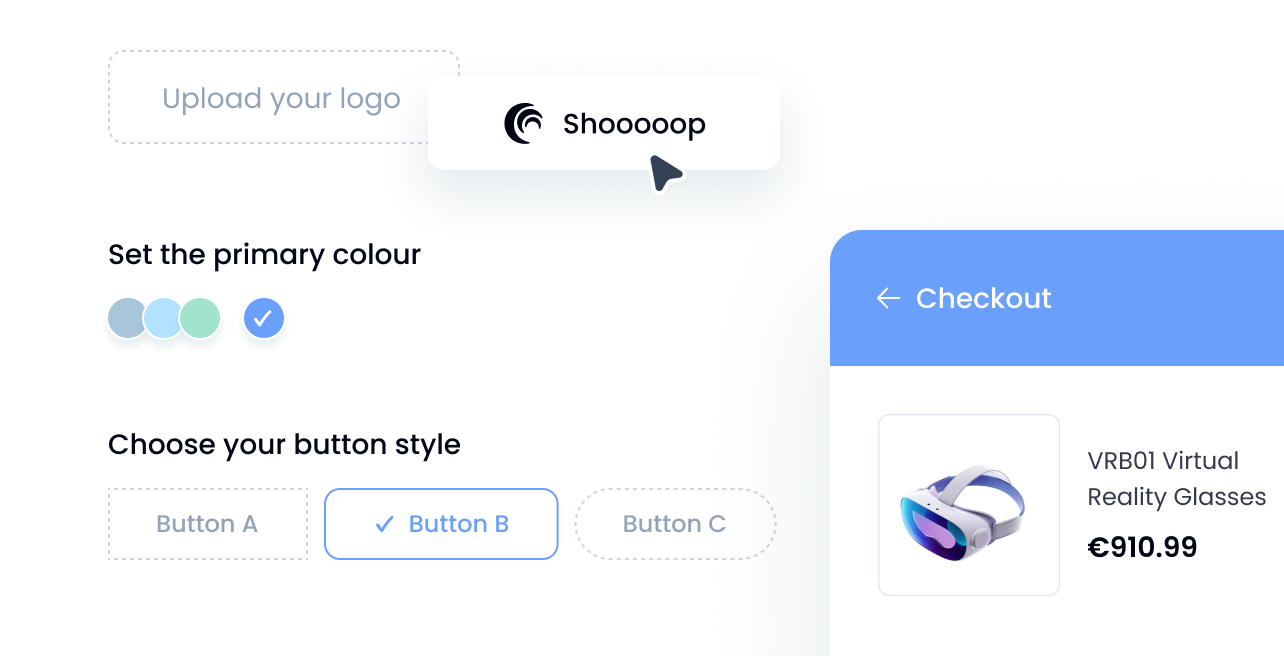

A wholly branded payment gateway PCI DSS Level 1 compliant designed to reflect the PSP's or acquiring bank's brand, where every aspect of the payment system can be customised — from payment pages and admin panel to logos and buttons. The payment widget and checkout page are also fully customisable to ensure a cohesive and seamless brand experience.

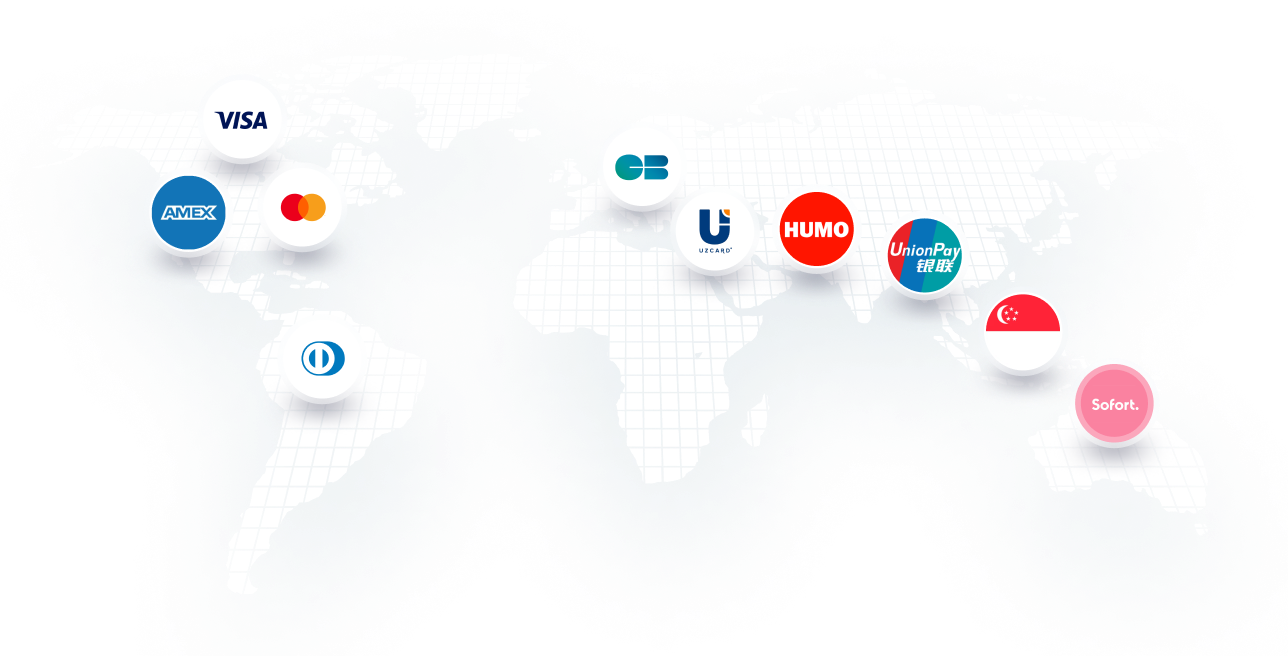

Quickly integrate local payment options, enhance conversion rates, and create seamless checkout experiences.

Active connectors with banks, payment methods

Multi-currency and cryptocurrency support

Apply flexible payment approaches, reduce fraud risk, split payments between parties, route transactions automatically, convert currencies seamlessly, and simplify payout management.

Our advanced Smart Routing allows you to configure security levels to fit your business processes, reducing losses from fraudulent and high-risk transactions.

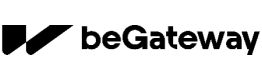

Get extended financial reports and manage the balance in real-time.

Know all the information about your merchants and their transactions to prevent unwanted situations promptly, both for their business and that of the merchant.

Gain access to detailed reports and visual insights into your business performance.

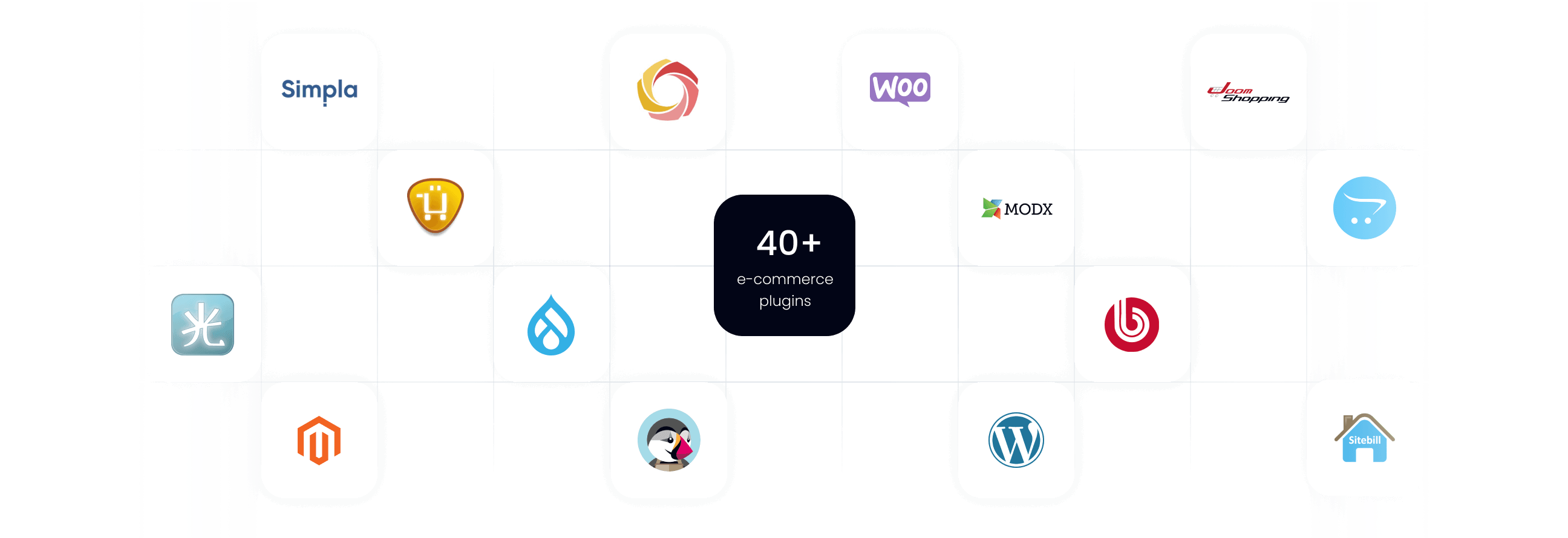

Empower your merchants to quickly and efficiently integrate payment options into their online stores using over 40 prebuilt e-commerce plugins. The simplified setup process streamlines integration, making it easy for merchants to get started.

Used for debiting funds for single-step payments.

Blocking of funds for two-stage payments.

Debiting of previously blocked funds for two-step payments.

Cancellation of the previous blocking of funds.

Payment to the client.

Full or partial refund of the previously debited amount.

Cancellation of a completed payment with a refund of the entire amount to the payer's card.

A bank-initiated chargeback occurs when the bank requires a refund after the merchant declines.

This process verifies bank details, limits, and 3-D Secure without sending transaction data to the bank.

Collection of fines for a chargeback.

Payout of funds from the account to the client's card.

Transfer of funds from card to card between private individuals.

Our technical support team is available 24/7 by default. They bring extensive expertise and in-depth knowledge of our payment platform. We provide peace of mind and a reliable safety net for our clients, ensuring that issues are promptly addressed and resolved.

Swiftly handling problems to keep your operations running smoothly.

Continuous monitoring helps prevent system outages.

Rapid solutions reduce the financial impact of disruptions.

Reliable support enhances your credibility with customers.

Rest assured, knowing expert assistance is always available.

We offer a range of options for clients who require additional Developers Team as a Service to accelerate their project timelines. We continuously develop new connectors with banks and payment methods in different countries based on client requests. Here are the three options we provide:

The development process takes 2-3 weeks during regular office hours, starting from the agreed-upon date.

For connectors needed on an expedited basis, one of our specialists completes development within 2-3 weeks, working outside regular office hours.

For clients who require more resources, we offer a dedicated team focused exclusively on developing new connectors and integrations.

25% 25% of our clients take advantage of technical support

For an additional fee, we communicate directly with your merchants and acquire banks on your behalf. This service prevents you from hiring dedicated technical support staff, saving valuable resources.

Installation from 1 week.

Installation on the PSP's servers from 3 months.

Installation from 3 months on the PSP's servers with full control to manage the system.

Our white label payment gateway, beGateway, is PCI DSS compliant. Since 2012, we have undergone annual security audits to ensure system compliance with PCI DSS standards. By renting our software, you receive a certified platform, eliminating the need to hire specialists and spend 15-20 thousand euros annually on certification.

Our white-label payment processing software is suitable for any business or organisation that provides payment acceptance services to merchants, such as PSPs or acquiring banks. We offer solutions, though not limited to, acquiring banks looking to accept online payments from their merchants, PSPs working with low-risk merchants, PSPs in the iGaming and Forex industries, and marketplaces that need to manage multiple merchants.

Yes, we develop integrations with new connectors upon request. Typically, we complete at least 6 new connector integrations per month, as ordered by tenants of our white-label payment gateway.

A white-label payment gateway is ready-made software that allows PSPs or bank acquirers to start processing payments under their brand using the third-party technical infrastructure.

In other words, a payment processing company with its brand - PSPs or bank acquirers - purchases a ready-made payment gateway from eComCharge and puts its logo on it to start processing payments immediately.

White-label payment gateway solutions offer PSPs of all sizes and bank acquirers the opportunity to build an online payment infrastructure with zero development costs quickly.