Automate High-Risk Onboarding: Streamline Risky Processes

Learn the best practices to automate high-risk onboarding, reduce security risks, and ensure a smooth, compliant onboarding experience.

For payment service providers and acquirers

Approval rate is the KPI everyone's fighting for

Payment channels are fragile and unstable

Cascades and split payments are essential

New providers are needed yesterday

Only you explain to merchants why payments fail

We built a platform that gives PSPs full control over their payment infrastructure — built around your strategy, not someone else's limitations.

Request demoGain instant insights into trusted vs. untrusted traffic at the merchant level. Use local or global data, and feed Smart Routing to improve approval rates and distribution.

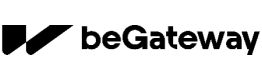

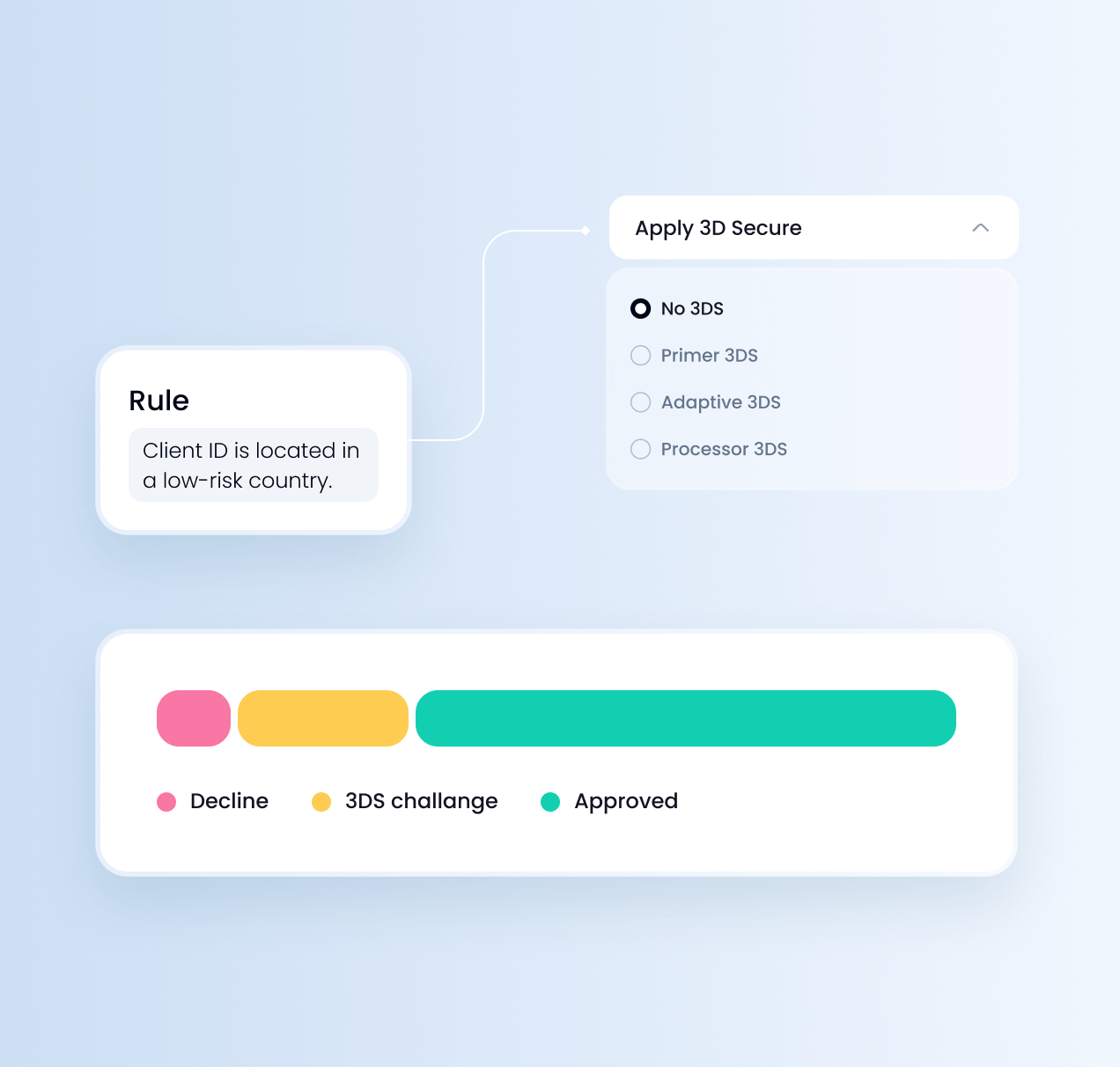

Take charge of authentication with your 3DS Server & MPI Server & MPI. Keep routing and providers invisible, apply frictionless / challenge/force 3DS by rule, and stay EMV® 3DS 2.0 (SCA/PSD2) compliant — including mobile and biometric support. Built to lift approval rates while minimising friction.

Clean, intuitive dashboard with filters, history, and export

API, iframe, prebuilt form, or CMS plugin — even without developers

Support for cards, Apple/Google Pay, recurring, and one-click payments

Local payment methods (upon request)

Fast processing and stable uptime

24/7 technical support

Clean, intuitive dashboard with filters, history, and export

API, iframe, prebuilt form, or CMS plugin — even without developers

Support for cards, Apple/Google Pay, recurring, and one-click payments

Local payment methods (upon request)

Fast processing and stable uptime

24/7 technical support

Typical gaps in generic gateways — capabilities vary by provider.

Yes. Our platform is built explicitly for high-risk verticals such as casinos, betting, forex, trading, and binary options. We offer optimised routing, flexible anti-fraud, and integrations with high-risk acquirers and PSPs.

You can go live in as little as seven business days. We offer both SaaS and on-premise deployment options, as well as prebuilt modules and full onboarding support.

Absolutely. You get your own brand, domain, notification emails, and UI for PSPs, agents, merchants, and sub-merchants. Your clients see only your brand - not ours.

Yes. You can connect and manage your own providers via our unified interface. We also offer fast onboarding of new connections on request.

We provide smart routing, A/B testing, fallback logic, real-time monitoring, and analytics - all designed to help you adapt routes and boost conversion across markets and banks.

Yes. You can use our built-in 3DS server or connect your own MPI. We fully support EMV® 3DS 2.0, SCA/PSD2 requirements, mobile flows, and biometrics.

Yes. We support direct integration with Praxis, allowing you to manage cascades, providers, and merchants from a single interface while optimising traffic and simplifying reporting.

You get a flexible anti-fraud engine with customisable rules, alerts, blacklists/whitelists (by card, IP, geo, device), and real-time monitoring.

Even without development, merchants can be onboarded via API, iframe, hosted forms, or CMS plugins. You have full control over limits, statuses, and flows.

We provide 24/7 technical support and assign a personal onboarding manager to assist with setup and go-live.

See the platform in action and discover how it helps high-risk PSPs grow faster while staying in full control of their payment infrastructure.

Request demo