Automate High-Risk Onboarding: Streamline Risky Processes

Learn the best practices to automate high-risk onboarding, reduce security risks, and ensure a smooth, compliant onboarding experience.

For payment service providers and acquirers

A ready-to-use white-label payment processing solution under your brand

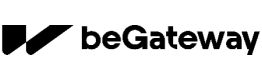

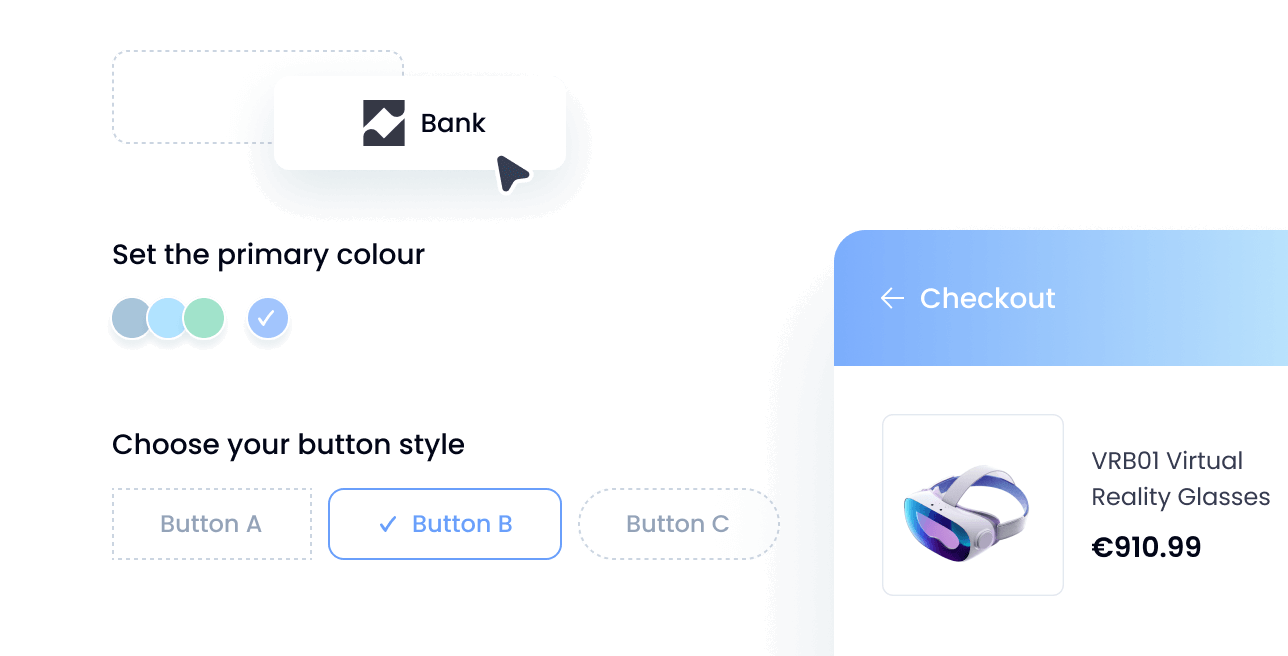

A wholly branded payment gateway PCI DSS Level 1 compliant designed to reflect the PSP's or acquiring bank's brand, where every aspect of the payment system can be customised — from payment pages and admin panel to logos and buttons. The payment widget and checkout page are also fully customisable to ensure a cohesive and seamless brand experience.

Quick launch from 1 week without the need to maintain servers.

Installed within the bank's infrastructure, ensuring full data control.

We offer 40+ CMS integrations including Shopify, WooCommerce, and OpenCart, along with fiscalization services tailored to regional regulations. For banks, we provide custom-built solutions such as split payments, marketplace transaction management, embedded finance tools, lending services, and API-driven integrations tailored to specific merchant needs.

beGateway powers modern banks and PSPs with secure, fast, and customizable payment processing across regions.

SaaS deployment can be completed within 1-2 weeks, while On-Premise integration typically takes 3+ months, depending on infrastructure requirements.

We comply with PCI DSS Level 1 and support 3D Secure 2.0, while also providing built-in fraud monitoring and blacklist/whitelist management.

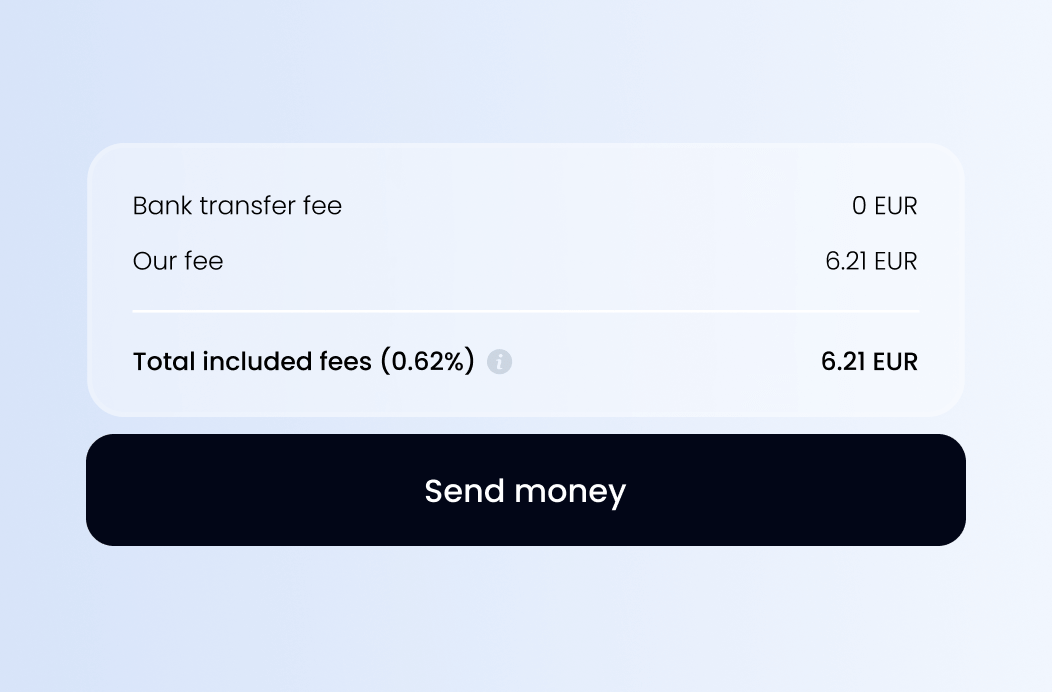

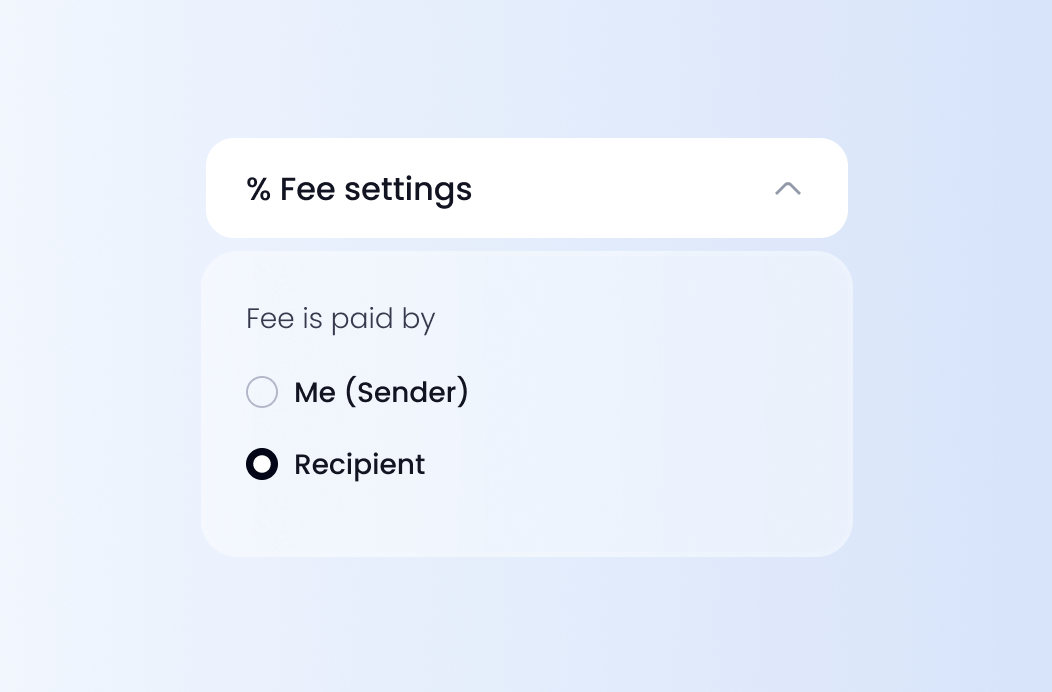

Yes, our platform allows full customization of fixed and percentage-based fees for different transaction types.

We support all card brands and local and popular APM, as well as Apple Pay, Google Pay, and Samsung Pay.

Yes, we provide automated real-time currency conversion and multi-currency balance management.

Yes, we offer API-based and host-to-host integrations, as well as custom solutions tailored to your bank's needs.

Yes, our support team operates 24/7 and provides assistance in English and other European languages.

Our system processes up to 20 transactions per second on a standard configuration, with scaling options up to 200 transactions per second.

We offer real-time transaction monitoring, financial performance reports, and fraud analysis tools.

We adhere to GDPR, PCI DSS, PSD2, and other regulatory requirements to ensure compliance with European banking standards.

Yes. We provide local data storage options to comply with GDPR/PSD2 and country-specific requirements.

Yes. We provide a certified 3DS server and MPI that lets you control authentication, improve approval rates, and even offer 3DS services to partners.

Contact us today, and we will help your bank launch a robust payment processing system in just weeks.

Request demo