Fully branded payment gateway tailored to the PSPs or acquiring bank's brand with a fully customisable and fully branded payment widget or page. It is deployed on the client's domains either as a SaaS solution or on their own servers. No administrative or development costs are involved, as the solution is ready to use and requires minimal setup. We provide a dedicated Data Warehouse for each PSP.

White Label Payment Processing Software

The payment gateway under your brand and payment orchestration are backed by a complete technical service and development team

solutions

Optimized payment solutions for various payment processing businesses

eComCharge offers fully branded, PCI DSS-compliant payment solutions ideal for businesses looking to enhance their customer experience through secure and efficient payment processing.

White Label Payment Gateway Solution for Payment Providers

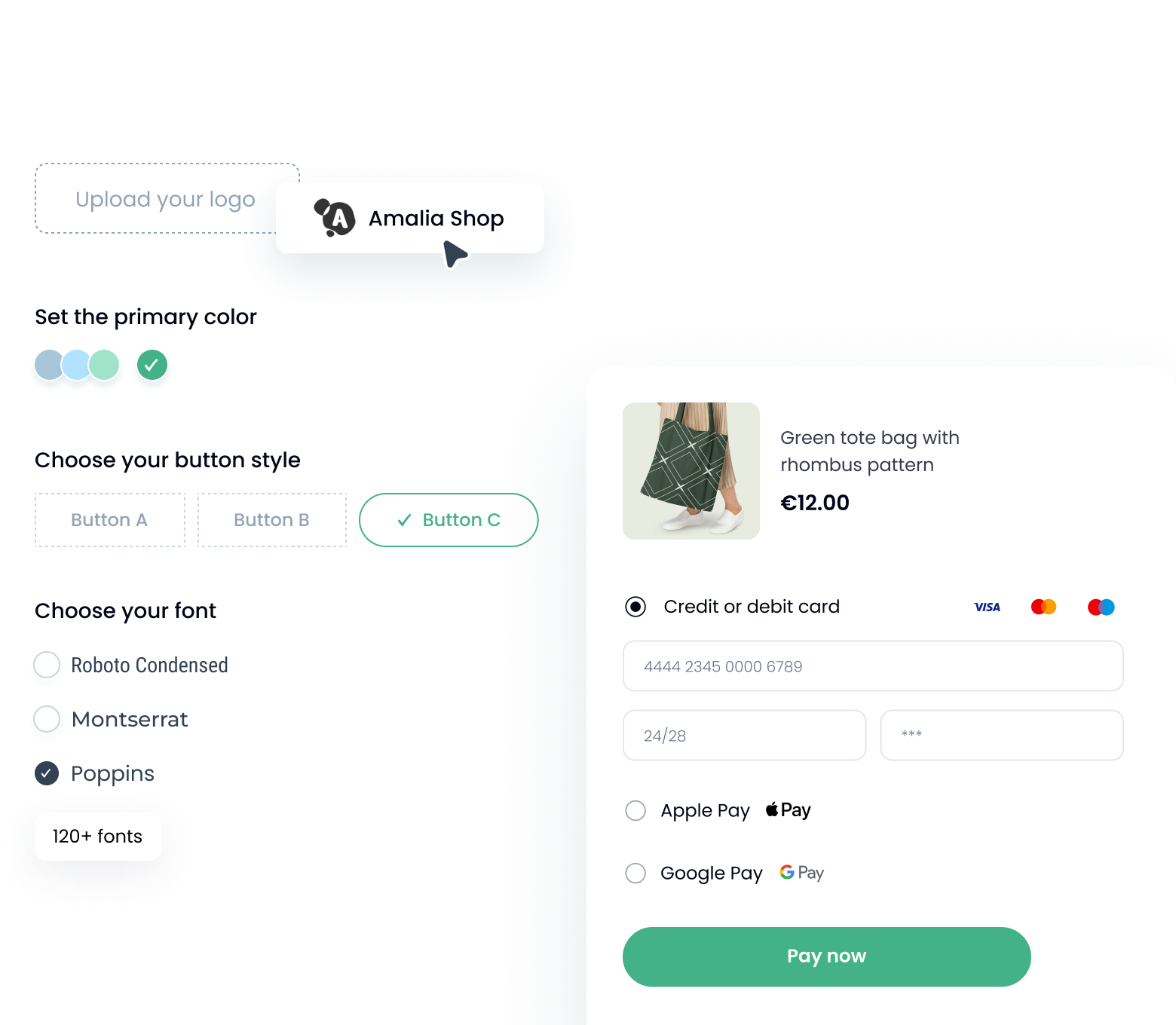

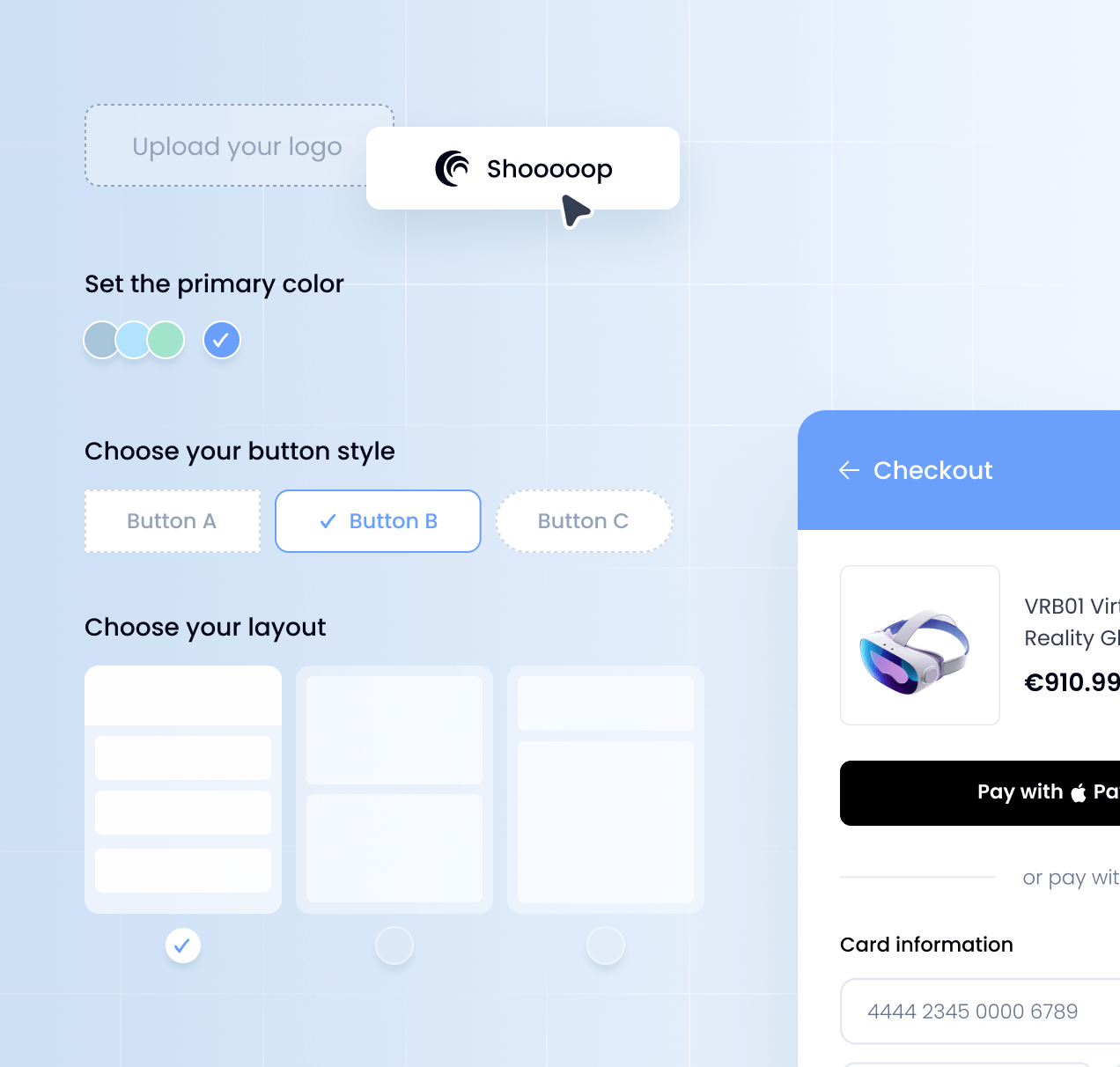

Fully customizable white-label payment gateway that aligns with your brand and specific business requirements.

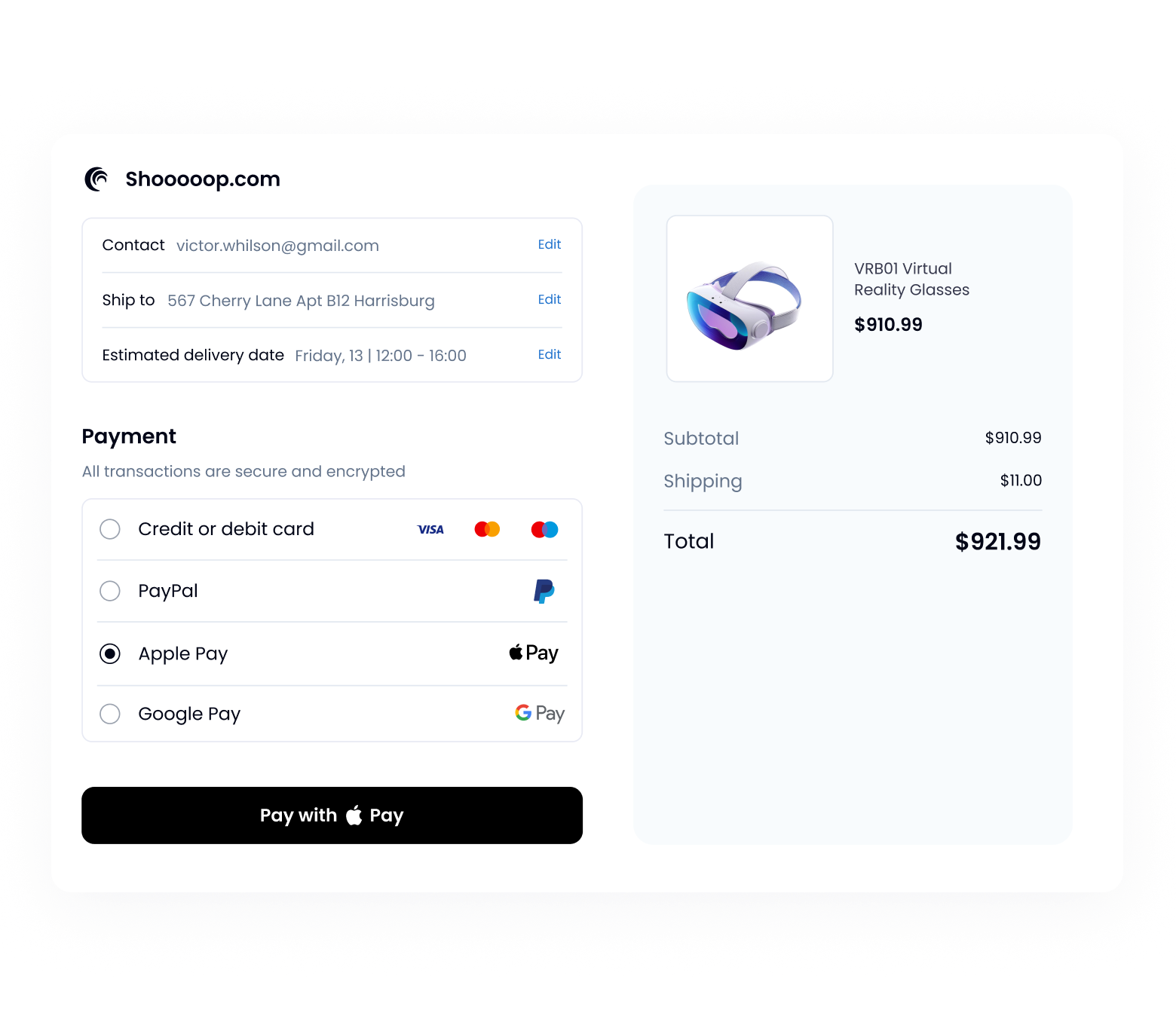

- Fully customizable, white-label checkout.

- Payment widget supports over 25 languages.

- Integration with Apple Pay, Google Pay, and Samsung Pay.

- Mobile SDK for easy integration.

- Compatible with 40+ shopping carts.

- Shareable payment links.

- Subscription management.

- Hold and auto-debit functionalities.

- Comprehensive compliance ans anti-fraud tools.

- SaaS solution deployable within one week.

White Label Payment Gateway Solution for Acquiring Banks

- Provide merchants with a fully branded payment gateway.

- Various payment methods include card payments, digital wallets, Apple Pay, Google Pay, and Samsung Pay.

- Customizable payment widget and checkout page, available in over 25 languages.

- Global tokenization technologies Visa Token Service and Secure Card on File by Mastercard.

- Your merchants can easily integrate with over 40 shopping carts or accept payments without integration by using payment links and process in-app payments via the Mobile SDK.

- Payment reporting and analytics, recurring payments, subscription management.

- We will deploy the system on your servers, ensuring complete control and security.

White Label Payment Gateway Solution for iGaming and Forex

Connect with international acquirers and PSPs, enabling multi-currency acceptance to scale your operations globally, no matter where your business is based.

- Smart Routing.

- 170+ Connectors.

- 3-D Secure Server to protect corporate data.

- Apple Pay, Google Pay, Samsung Pay.

- Auto-currency conversion. Crypto-support.

- Payment splitting.

- Cascading.

- Tokenization.

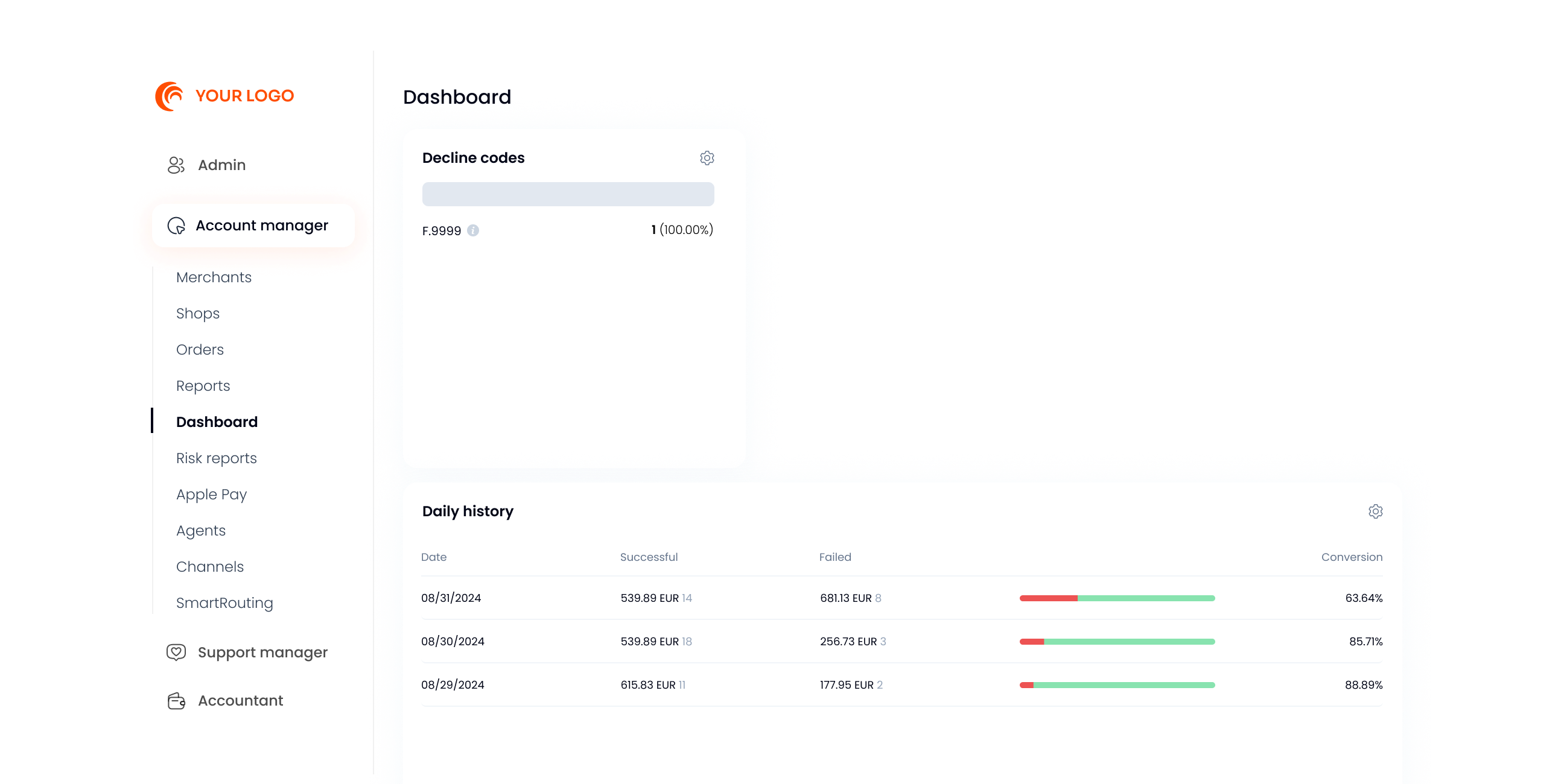

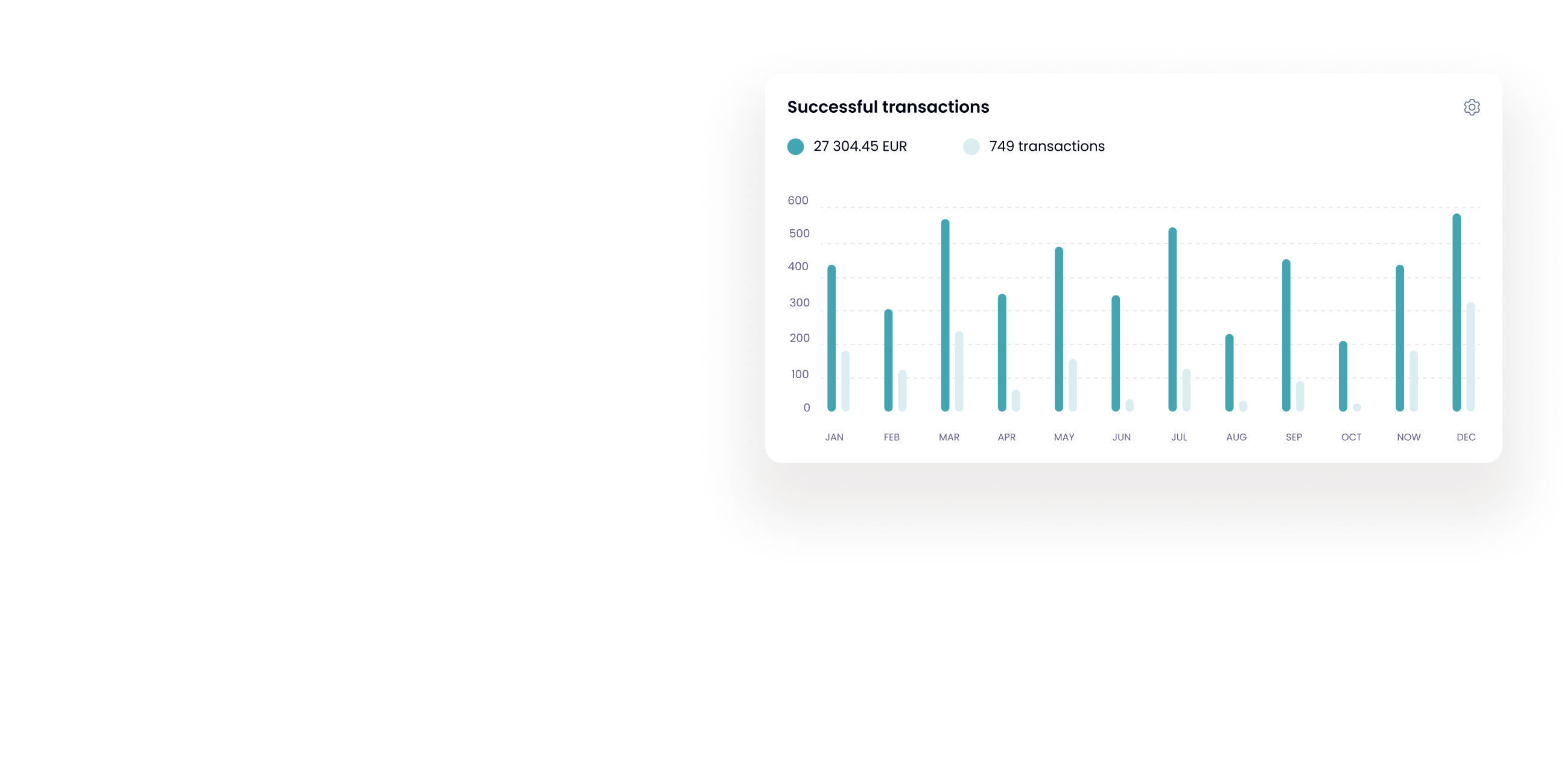

- Real-time reporting & analytics.

The system can be implemented as a SaaS solution within a week.

Payment Orchestration Platforms for Payment Providers

A comprehensive payment orchestration solution powered by Smart Routing for payment service providers. Our payment orchestration solution empowers PSPs to efficiently manage and optimize payment flows by routing transactions according to the pricing and conditions set by various acquirers and banks. It minimizes exposure to fraud and high-risk transactions, while intelligently distributing transaction loads to avoid acquirer bottlenecks. PSPs can also enforce transaction limits in line with acquirer policies and implement tailored processing rules for individual providers, merchants, or stores.

This comprehensive solution enhances security, streamlines operations, and reduces costs, offering PSPs greater control over their payment ecosystems.

Payment Platform for Marketplaces

A white-label processing platform designed for marketplaces, it enables seamless payment management for multiple merchants. The solution offers:

- Automatic revenue sharing.

- Customizable commission structures.

- Integration with 40+ shopping carts.

- Merchant payment management with split payments and cascading.

- Fraud prevention and risk management for secure transactions.

- Subscription and recurring payments for vendors.

- Support for multiple currencies and payment methods like Apple Pay and Google Pay.

- Custom reporting and analytics to optimize sales and commissions.

software

Unleash the potential of white-label payment processing software

Experience a new standard of efficiency and control with our comprehensive feature set, designed to enhance your payment ecosystem. Leverage advanced Smart Routing, detailed analytics, deployment as SaaS or on-premises, PCI DSS Level 1 certification to elevate your business operations and unlock the full potential of your payment solutions.

Our technical team can set up the white label payment processing system as SaaS within one week, provided all integrations with necessary connectors are ready. Our technical specialists can activate all pre-built integrations with connectors with a single click.

You rent an already PCI DSS Level 1 certified system, so you do not need to consider or undertake its certification. Under the licensing agreement, you receive a certificate issued in the name of our company, eComCharge. However, we also offer you the option to obtain a PCI DSS Level 1 certificate in your company's name for a small additional fee, which you must pay annually.

We set up and managed the transaction routing system, controlled and monitored transactions, and configured fraud control. Our Smart Routing goes beyond standard payment flows, offering PSPs advanced control and optimisation based on client feedback.

With Smart Routing, PSPs can route payments based on the costs and terms of different acquirers and banks, reduce losses from fraudulent and high-risk transactions, distribute transaction loads to prevent acquirer overload, manage transaction limits based on acquirer restrictions and apply customized rules at the provider, merchant, or store level. This solution helps PSPs optimize processing, enhance security, and lower costs.

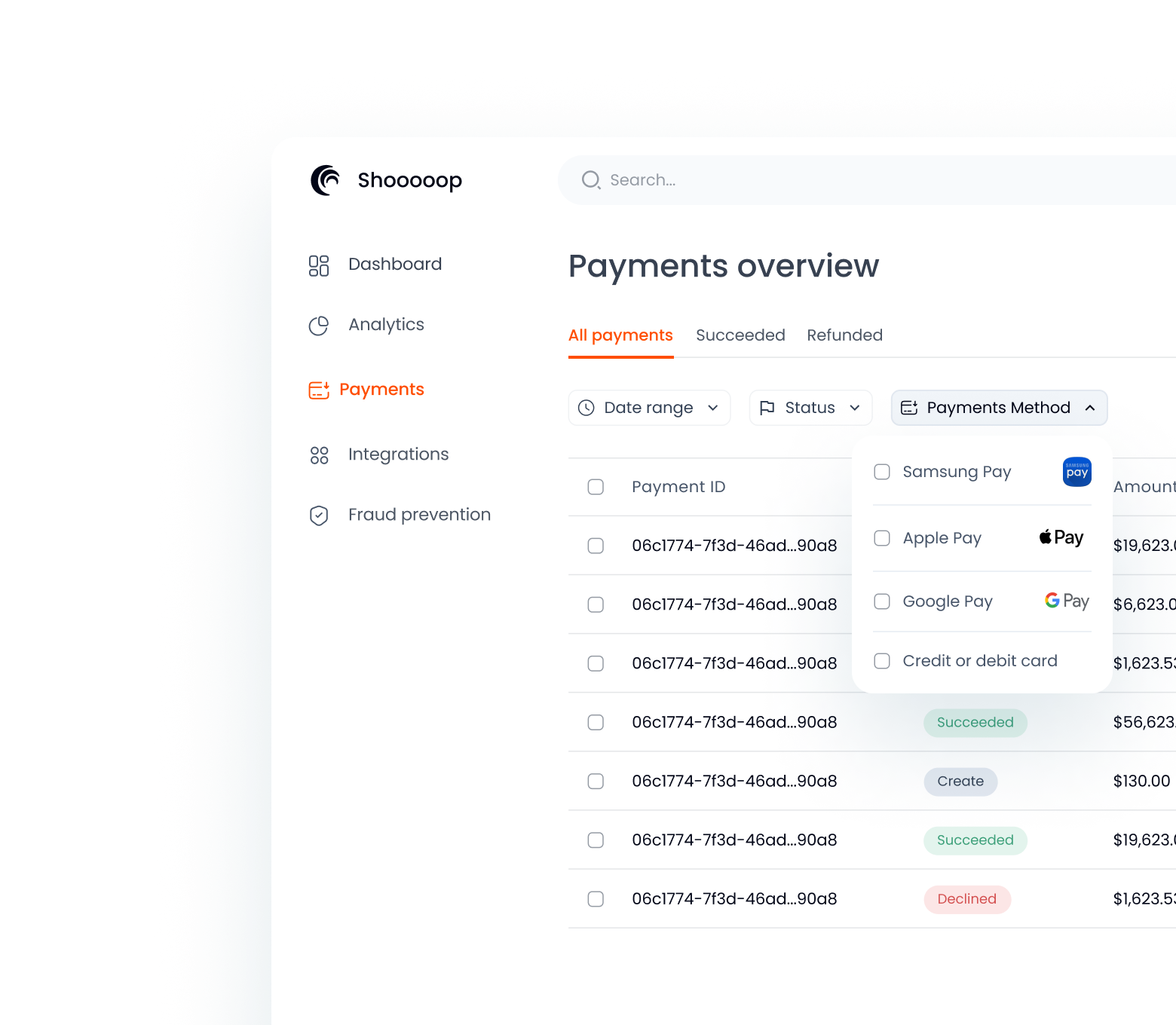

Our reporting and analytics feature offers convenient data viewing, multiple export options, and seamless integration with the PSP Report API for effortless data management. It provides valuable insights into sales performance, chargebacks, refunds, fraud declines, settlements, and payment trends, allowing you to analyse sales by country and optimise your business operations.

Our on-premises deployment offers PSPs and acquiring banks complete control and customization of their payment gateway infrastructure. With our vast experience in this area, we efficiently handle the setup process, which typically takes about three months. During this time, our expert technical team configures and installs your servers from scratch, ensuring everything is tailored to your business's specific requirements. This approach allows you to fully own your infrastructure while benefiting from a fully branded, high-performance solution.

Our tokenization solution fully complies with PCI DSS security standards, ensuring the highest level of protection for your customer's data. In addition to the widely adopted tokenization methods, we offer cutting-edge Global Tokenization Technologies. Since 2022, our white-label payment processing software has supported the Visa Token Service (VTS), and starting in 2024, it also supports Mastercard's Secure Card on File (SCOF) technology.

Our company offers an advanced Token Authentication Service provided by Mastercard that enables merchants to perform seamless cardholder authentication during checkout. This feature allows customers to authenticate payments using biometric data, such as fingerprints, instead of traditional passwords. The authentication service is available as part of the merchant or digital wallet's token implementation, reducing integration efforts to authenticate cardholders during checkout.

Our certified 3-D Secure 2.0 Server offers PSPs complete control over the payment authentication process. It is now certified to work with Visa, Mastercard and China UnionPay, allowing PSPs to verify cards directly through their own 3DS server. This ensures that the payer is not redirected externally, giving PSPs complete oversight and management of the transaction flow. This server allows PSPs to securely store corporate information about their partnerships with banks and payment providers, enhancing security and operational control. As a PSP, you independently communicate with the issuer's ACS, control the data you send, manage the redirection timing, and handle the response from the issuer's ACS before forwarding it to your acquiring bank.

Our white label payment software is fully integrated with Apple Pay, Google Pay, and Samsung Pay, allowing your merchants to offer their customers seamless, secure, and convenient payment options. These mobile wallets support fast, one-touch payments, enhancing the user experience while ensuring compliance with the highest security standards. By enabling these popular payment methods, you can increase conversion rates and provide a frictionless checkout experience across multiple devices and platforms.

Our Mobile SDK for Android and iOS enables PSPs to integrate secure payment processing into mobile applications seamlessly. It supports primary payment methods, including Apple Pay, Google Pay, Samsung Pay and card payments, while offering a customizable UI to match your brand. The SDK is PCI DSS compliant and supports 3-D Secure 2.0 for enhanced security. This solution allows PSPs to provide merchants with an efficient, mobile-friendly payment experience, boosting conversion rates on mobile platforms.

Our white label payment software offers seamless compatibility with over 40 shopping cart platforms, making integration quick and hassle-free for your merchants. Whether using Shopify, WooCommerce, Magento, PrestaShop, or other leading e-commerce platforms, your merchants can easily connect their online stores to your payment gateway. This wide range of supported shopping carts ensures that merchants of all sizes and industries benefit from a smooth payment setup, enhancing operational efficiency and streamlining the payment process.

integration

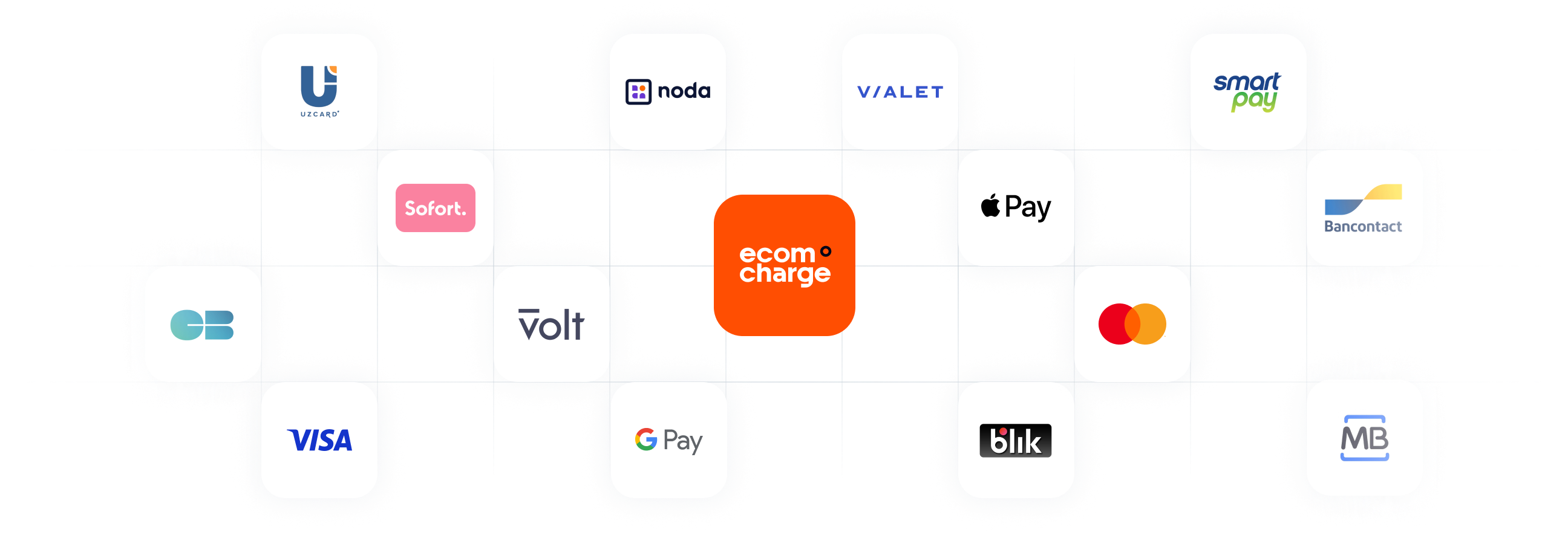

170+ active connectors for seamless global payment integration

The eComCharge integrational team consistently perform at least six new direct integrations with banks and payment methods based on the requests of our system's tenants. With over 170 active direct connectors used regularly and exceeding 200, our white-label payment platform ensures businesses can access robust payment solutions.

For clients in the Central Asian region, we offer ready-made connectors for 🇰🇿 Kazakhstan and 🇬🇪 Georgia, enabling seamless access to payment processing solutions in these markets.

Why eComCharge

Choose eComCharge

-

Set up your fully brandable payment gateway software in as little as one week, with 24/7 technical support for you and your merchants. Upon request, our integration team will handle any necessary connector integrations for you

-

With over 125 successful launches of payment processing service providers globally, including e-commerce projects in the banking sector, eComCharge brings extensive experience in multinational environments. We have executed projects across Europe, the Caucasus, Central Asia, and collaborated with companies in the US, Singapore, and Canada. Additionally, eComCharge partners with the German EV charging platform Landis+Gyr, providing secure technical connections between local EV charger operators and acquirers/PSPs.

-

Since 2011, we have continuously invested in developing our white label payment processing software, offering a robust system with extensive features. Our software is best for those seeking a strong and reliable backend. The PSP backend is the system's heart, ensuring security, payment processing, seamless connectivity with financial institutions, and real-time transaction support.

-

We offer a range of options for clients who require an additional Developer Team as a Service to accelerate their project timelines. Based on client requests, we continuously develop new connectors with Acquiring Banks and PSPs in different countries. For clients who require more resources, we offer a dedicated team focused exclusively on developing new connectors and integrations.

-

We communicate with your merchants and acquire banks on your behalf. This service eliminates the need to hire dedicated technical support staff, helping you save valuable resources. Around 25% of our payment processors opt for this service.

Frequently asked questions

To quickly deploy the system under your brand, you should already have:

- Registered company

- Domain name

- Business bank account

- Acquiring account in a bank or payment service provider

- Logo and other elements for system design under your brand

We offer flexible pricing models tailored to your business needs. These typically involve a one-time setup fee and ongoing monthly fees based on transaction volumes. Detailed pricing will be provided after we assess your specific requirements.

Our software is designed to comply with global and regional payment regulations, including PSD2, GDPR, and other local laws. We stay current with evolving compliance requirements, ensuring your PSP remains fully compliant wherever you operate.

The current system throughput is 200 transactions per second. With a guaranteed system uptime of 99.75%, the white label payment software beGateway ensures reliability through various measures:

- It utilizes network infrastructure provided by Amazon Web Services.

- The software employs isolated services with messaging exchanged between them.

- It supports both synchronous and asynchronous interaction of system components.

- Database duplication is implemented to enhance data security.

- Protection against DDoS attacks is provided through CLOUDFLARE.

- The software enables the simultaneous operation of two or more instances of critical system components with automatic load balancing.

- Customizable real-time monitoring of all applications and subsystems is supported using Grafana, Sentry, and Kibana.

Yes, besides our headquarters in Vilnius, Lithuania, we also have an office in Almaty, Kazakhstan.

Yes, beGateway is the name of our product – a white label payment processing software which we have been offering as a white label solution since 2012.